How to budget for a business

How to budget for a business plan

![]()

Budget planning – approaching the process

Whilst a simple approach to the business budgeting process always leads to a cluttered and imprecise result, the goal of creating a budget plan with high accuracy can be achieved only with a deep, complex and time consuming exercise that always chases away the managers from what they do best: leading and deciding. Rather than recalling the details of the budgeting theory, this page is introducing a practical answer to the question “how to budget for a business”, as one of the core activities for creating a financial plan.

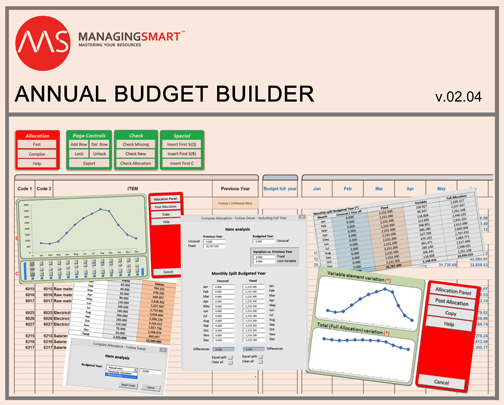

The answer is supported by a tool based on complex algorithms running inside Excel spreadsheets, linked together in an incremental budgeting software, via a simple and user friendly interface. The solution is designed to dramatically reduce the effort and the amount of time consumed for issuing a high quality budget plan. Before starting, we must review some basic theoretical principles, not more than what we need for setting the scene and understanding how the figures will be aggregated within a budget calculator.

Budgeting techniques

![]()

There are two main directions that statistically cover the process: “Zero based budgeting” and “Incremental budgeting”. In fact, there is a third technique as well, too often used in real life, where lack of time or resources forces a manager to fill in the budget plan with “common sense” figures, hoping that they will fall close to reality. Since the third technique never paid off, we should focus on the first two.

Incremental budgetingUsually being considered as “traditional”, the method consists of creating a budget plan by calculating the values of its items starting from previous performances and adding or subtracting incremental amounts, in order to account for estimated changes that will occur in company activities. Incremental methods are used when the external and internal business environments are relatively stable and are applied for items that are business driven – which, in fact, represent the majority. Such a scenario happens in most of the situations and the past evolutions are highly relevant (the past real figures, together with assumptions about the future, are used as the ground for estimating the future evolutions of the budget items within the budget plan). The main drawback is that possible inefficiencies from the past activities will not be challenged and will be carried forward to the budgeting period, the final result of this being extra expenditures, since the practice proved that any spare resource has the tendency to be consumed with no benefit. On the other hand, the method requires less resources and we will also prove that its accuracy and time efficiency can be dramatically improved by using a proper incremental budgeting software. In practice, this is the most used budgeting technique, since many companies either do not hold the necessary resources for a zero based budgeting process, or they consider that it is not worth the effort. | Zero based budgetingBeing different in many aspects versus the incremental budgeting, this technique usually represents an attempt to fully calculate the value of each budget item "from scratch", with little or no reference to its past evolutions. The method is accepted as being the most accurate, mainly because of not carrying forward the supposed inefficiencies that were accumulated in the past activity. The main drawbacks of the method are: massive specific resources required, intensive manual work involved and long time to be performed. The process is almost impossible to be covered by standard budgeting software, due to the individual unique behaviour of the budget items. Overall, it leads to high costs that might be worthwhile or not, depending on the company resources and policies. One word here about a limited number of special items that are mainly driven by financial components (such as: leasing rates, interest for loans, depreciation, taxes, etc.), or about new activities started by the company - they should be always budgeted (calculated) from scratch. |

In the light of the above dual approach, one might find unclear how to budget, however, the clarification stays within the characteristics of the two techniques. A decision can be taken under specific management assumptions, as follows:

– Take the incremental budgeting (the most used within organizations) if the past period evolution is known and if it is not supposed to contain material unknown inefficiencies (the known ones can be very well adjusted with this method), or if the high level of resources to be spent in budgeting from scratch does not seem to bring sufficient benefits that exceed the cost of such a process.

– Take the zero based budgeting, if there is no history of past evolutions (a start-up for example), or if the benefits of removing supposed material unknown inefficiencies from the past are susceptible to cover the high cost of the process.

Budgeting for business – Main elements and concepts

![]()

There is valuable information available over the internet about the process, however, it generally touches the theoretical aspects only, without offering practical examples or incremental budgeting tools. This page and the next one aim to offer a practical way for creating a budget plan, together with a downloadable software proposed to be used for managing the complex calculations and algorithms involved. There is a number of basic elements and concepts that must be understood before starting incremental budget creation for a business plan. Some of them come from the general theory, whilst some other arise from practical experience, as follows:

| 1. Budget items: | Represent the main elements of the budget plan, respectively Volumes (Quantities), Revenues and Costs. |

| 2. Fixed items: | Revenues or Costs (or their elements) that do not change with the increase or decrease of products / services that are produced or sold. As a variance, a “stepped cost” represents a long term increase or decrease in the Fixed Costs, as a result of a specific event in the activity of the company. For example: renting of a new storing capacity generates a “stepped” increase in the rental Fixed Costs of the company. |

| 3. Variable items: | Those Revenues or Costs (or their elements) that vary proportional with a Driver (most often with the Volumes produced or sold). |

| 4. Unusual items (sometimes called “one-off”): | Revenues or Costs that do not arise as a result of the usual activity of the company. They do not behave as Fixed, nor as Variable items; they occur unexpectedly, during limited periods. Example: a one-off penalty for late payment coming from an accidental delay in paying a supplier; the manager should decide whether the impact of such temporary malfunction should be included or not within the future budget plan. |

| 5. Drivers: | Budget items (Volumes produced or sold, for example) that have a direct influence over the evolution of other items. For instance, an increase with 10% in Volumes produced will generate 10% increase in Costs with raw materials; the same increase is susceptible to generate 10% increase in Revenues, if the selling price is not changed. |

| 6. Trends: | Serial of numbers that drive the behavior of particular budget items. During the incremental budgeting process, they act in the same way with a Driver, the difference being that Trends can be abstract figures (the figures from a seasonality chart, for example), whereas Drivers are figures coming directly from budget items evolution over the time. |

| 7. Previous period: | The period that precedes the budgeting period, and for which real figures are available, arising from the activity carried by the company. |

| 8. Budgeting period: | The period for which the process is carried (usually one year, remaining part of the year or a given number of years). |

| 9. Allocation methods: | The most important elements of the process and represent the algorithms that are used to link together the previous period figures, the drivers and the assumptions about the future, in order to lead to an estimation of the budgeted items as close to reality as possible. |

Budget planning process – accuracy and accountability

![]()

There is a common misconception saying that a business budget plan is good only if it will match (almost) perfectly with the future reality, somehow like a high precision clock. But, as a matter of fact, when we say “budget”, we implicitly assume a margin of tolerance, mainly due to the fact that the process itself is an estimation based on a huge number of business assumptions regarding the future evolution of company activity. And we must accept that, as long as the business assumptions about the future are relative, the budget plan also becomes relative in a certain extend, which leads to the necessity of timely revisions. There are, however, a number of actions to be taken in order to assure the consistency of the process:

» Follow all the main elements and systematically apply the concepts listed above, during the budget plan creation.

» Identify (best estimate) the Fixed, Variable and Unusual components inside all of the items, separately plan for them and finally aggregate the results; such a detailed approach brings a dramatically increase in accuracy, even if it is done with estimates and not with calculated amounts.

» Use fully featured budget calculator, if available. It would increase time efficiency and accuracy, given the fact that the process is heavily driven by a huge number of simple or complex calculations.

» Write down the assumptions made for sensitive elements. This will be of tremendous help later, for explaining the deviations and for generating future assumptions closer to reality.

Now, as the basics of creating a budget have been covered, the next chapter might be of high interest:

Tutorials and videos about how to budget in practice, using a specialized software. Budget planner software available for download. Free demo and detailed Help files included.

![]()